|

The Truth Examines Despicable Lending Practices – Part 3 –

Mortgage Predators

By Zahra Aprili

Sojourner’s Truth Reporter

We all know the proverbial saying— “Home is Where Your Heart

Is.” But that does not actually answer the question “What is

a home?”

The word home refers to the shelter where a person, family

or group of people live. Depending on where the home is

situated in the United States, it could be in the form of a

detached house, town home, condo or apartment building. Not

only is that definition broad and general, but it also lacks

emotional perspective! Let’s be specific, shall we? Let’s

look at our immediate area – northwest Ohio. What does the

word HOME mean in here?

For Sally (not her real name), a young mother, home is a

parcel in South Toledo that has a brick one story house and

detached garage. The house has three bedrooms and one and a

half baths. It is a piece of property and the house on that

property, where she felt secure. So secure that it was the

place in which she wanted to dwell and raise her children.

For reasons unavailable to this journalist, Sally entered

into an informal written agreement with a local property

company for the purchase of the house previously described,

for an agreed price of little over $15,000 in early 2014.

Court records indicate that Sally paid the company

approximately 36 percent of the purchase price upon entering

the agreement. Sally and the owner of the property company,

Mr. -------, met downtown at the Government Center to fill

out forms and other documents needed for the sale and

purchase. For the period of one year, she made regular

monthly payments on the house and two additional lump sum

payments. Mid-year, 2015, Sally made her final payment

fulfilling the purchase agreement and completing the

purchase of her first home.

Unfortunately, Sally’s story is not over. Instead of the

feeling of accomplishment, satisfaction, and security that

accompanies home ownership. Sally faced betrayal and deceit.

A month after making her final payment, she was contacted by

Mr. ------ who demanded more money from her for the purchase

of the house. Sally refused and three days later a

fraudulent Quit Deed Claim was filed transferring the

property back into Mr. ------ name. It turns out that while

both parties were down at Government Center at the

commencement of the transaction, Mr. ------- instructed

Sally to sign this form and later discovered that:

“Unbeknownst to Sally, Defendant --------- secretly retained

the Deed and later had it notarized outside of Sally’s

presence and without her knowledge.”

One day after, filing the Quit Claim Deed, Mr. ----------

began eviction proceeding against Sally and her children.

Around that same time, Sally went downtown to secure a copy

of her deed, where she learned that the house was no longer

in her name.

Sally was smart and she did not let herself get bullied. She

kept copies of all her payment receipts; she filed a police

report and contacted Legal Aid for help. It is 2017 and

Sally is just starting to see the light at the end of the

tunnel. Her case was recently scheduled to be heard in court

and we hope that the outcome is in her favor.

Sally’s case is just one example of how the dream of owning

a home can go wrong. Unfortunately, she is not an exception

to the woes that plague potential homeowners in Toledo.

A number of questions spring to mind about why Sally ended

up with a loan from someone whose business practices either

could not be verified or were blatantly not above board?

Why not obtain a mortgage from a conventional lending

institution such as a bank? Had Sally applied for a

conventional loan and been turned down? Or, had Sally, aware

from past experiences or interactions with others in her

neighborhood or of her background, assumed that an

application for a bank loan would not go well?

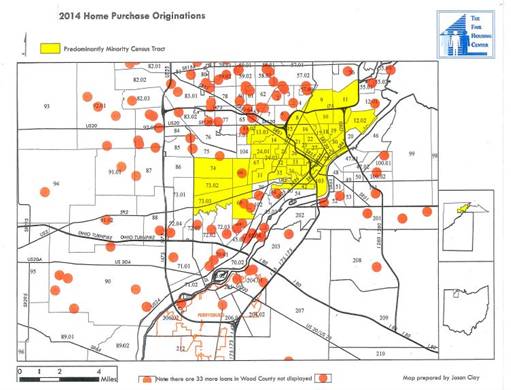

Below

is a 2012 Fair Housing map of Lucas County. The areas

highlighted are Low-Income and Moderate Income census

tracks. The dots represent bank loans for home purchases. In

2012, two percent of local bank loans in Lucas County

originated in low-income and moderate-income census tracks.

These census tracks are predominately minority. What is the

justifiable explanation for that number being so low?

Below, in this 2014 Fair Housing Map of Lucas County shows

loan originations in the predominately Minority Census

tract. In 2014 there was virtually no lending occurring with

minorities in Lucas County. ZERO. How is that the case when

we know that in 2014 people like Sally were living, working

and purchasing homes in the area?

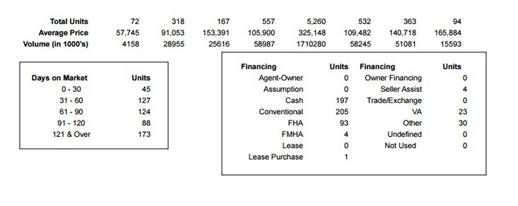

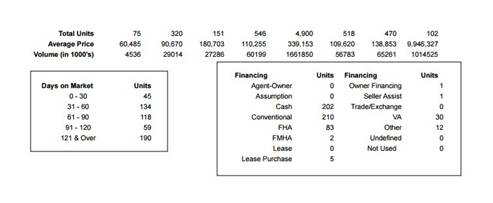

NOVEMBER

DECEMBER

The information above is a summary of financing statistics

for the months of November and December, 2014 from

the

Northwest Ohio Real

Estate Information Systems' (NORIS.)

Why was there no lending originating from local banking

sources in these minority census tracks?

According to Jen Teschner, senior manager of Systemic

Investigations for the Toledo Fair Housing Center, given the

availability of houses in low-to-moderate income

neighborhoods and the population therein, the equitable

amount of loans in these neighborhoods should be in the area

of nine percent. That was the goal that Fair Housing was

shooting for, and could see some progress in attaining, in

the years prior to the great recession that began in 2008.

“We felt lenders were making progress in proportional

lending,” says Teschner. “Since the great recession, lending

has come back, but not proportionally in communities of

color.”

Yes, houses were being bought and sold in northwest Ohio. In

November of 2014 there were 205 conventional loans and in

December 210. But none of them were from local banks to

minority customers. Theses graphics show Lucas County went

from two percent of loans going into minority census tracks

in 2012 to -0- in 2014. The 11/2014 and 12/2014 tables are

only a snapshot, 1/6, of the disproportion that occurred in

2014.

So, what is a home? Most would agree that the definition

given at the start of this piece is an accurate definition.

It is the place you are building your memories. It is the

security of knowing that the place you lay your head is

yours. It is the individual and family wealth that you are

building.

However, on some streets and neighborhoods in the City of

Toledo, County of Lucas, it is an illusion. An illusion

fueled by institutionalized discriminatory practices. An

illusion enabled by the abandonment of community and local

financial institutions removing their accessibility from

would be borrowers. An illusion clothed then stripped by

mortgage lenders that did not care about the effects of

their practices or impact on the communities they entered.

Illusions spun by mortgage lenders like American Equity

Mortgage and Beneficial, companies who are known to have

participated in practices that have been labeled predatory

in function.

FIRST TIME HOME OWNER? FINANCE, REFINANCE, HOW ABOUT A HOME

EQUITY LOAN FOR SOME IMPROVEMENTS? Sign Here, Here and Here.

Psst…If you are elderly or a person of color we especially

want to help. Why settle for just an equity line, let us

show you our platinum refinance plan.

Did you sign for a “quick” mortgage that had no documents or

papers? Did a representative convince to you go with a loan

product that you did not initially want or need? What about

an interest only loan or a loan that has huge end of life

payment, known as a “balloon” payment? Have your payments

been properly credited?

Unjustified fees; inflated interest; including the debt from

unsecured sources like credit cards or medical bills;

inflation of “points” or what the lenders fee is for making

the loan; penalties for early repayment or prepayment, are

all examples of practices that mortgage lenders used to

increase their profits while subjecting unsuspecting

consumers to unjust lending terms. Have you been victimized?

Take the time to look at your current mortgage; it is not

too late to seek help. If you have not purchased a home in

Toledo using financing, you now have some background. When

it is all said, and done, having a home and keeping it

should never be an illusion or just a dream. It should be a

reality.

Ed Note: This is the end of Part 3 of our series on

predatory lending. Part 4 will start next week focusing on

predatory lending in auto loans.

|